1. The Financial Reporting Challenge

The sector’s challenges stem from complexity in:

- Data Landscape: Dozens of source systems, inconsistent schemas, legacy databases

- Regulatory Change: Basel III/IV, IFRS 9/17, FATCA, ESG reporting standards

- Operational Metrics: Risk-adjusted returns, capital adequacy, asset performance, liquidity ratios

- Client and Product Views: Aggregation across instruments, accounts, and regions

- Decision Timeliness: Executive dashboards require real-time or near-real-time inputs

Yet most firms rely on:

- Manual extraction and transformation using Excel

- Inconsistent definitions of risk, capital, or profitability

- Repetition of logic across reports with no reuse or lineage

- Outdated or unscalable BI stacks

2. Power BI in the Financial Sector: More Than Visualisation

Power BI is often misunderstood as just a visualisation tool. In practice, it provides a scalable enterprise reporting framework with features essential for financial institutions:

- Advanced data modelling with DAX and Power Query

- Integration with SQL, SAP, Oracle, and cloud systems (Azure, Snowflake, etc.)

- Row-level security and access management

- Scheduled refreshes and self-service capabilities

- Report version control and data lineage for auditability

With the right foundation, Power BI becomes the final delivery layer of a sophisticated data architecture.

3. Building the Foundation: Data Modelling and Meta-Modelling

Data Modelling: Turning Raw Data into Logic and Insight

Financial services demand semantic models that translate raw tables into finance- and risk-intelligent outputs:

- Star and snowflake schemas to separate facts (e.g. transactions, risk exposures) from dimensions (e.g. clients, time, products)

- Calculation of derived measures (e.g. cost of risk, duration-weighted exposure, regulatory capital) using DAX

- ETL processes using Power Query to clean, transform, and load

Meta-Modelling: Engineering Reuse and Consistency

Meta-modelling is critical to enterprise scale. It involves:

- Defining models of models: shared business terms, KPIs, hierarchies, and calculation logic

- Enabling report reusability and consistency across functions and jurisdictions

- Creating governed reporting frameworks that align regulatory, financial, and operational metrics

- Ensuring data lineage, documentation, and auditability

By abstracting reporting components, firms reduce duplication and enforce a single version of truth.

4. Case Scenario (Fictional but Realistic)

Client: A UK-based diversified financial group operating in retail banking, insurance, and asset management

Problem:

- Dozens of fragmented reports for executives, operations, and regulators

- Weekly risk reporting involved manual Excel extractions from 11 systems

- No consistent definitions of capital adequacy or cost of risk

Solution:

- Introduced a meta-model covering definitions of key metrics (risk, capital, returns, client profitability)

- Created unified semantic models for asset classes, exposure types, business lines

- Built Power BI reporting packs for executive dashboards, regulatory KPIs, and investment committee metrics

- Integrated reports with Azure Synapse and a data lakehouse

Results:

- Report production time reduced by 72%

- Single source of truth across risk and finance

- New self-service analytics enabled for investment teams and compliance

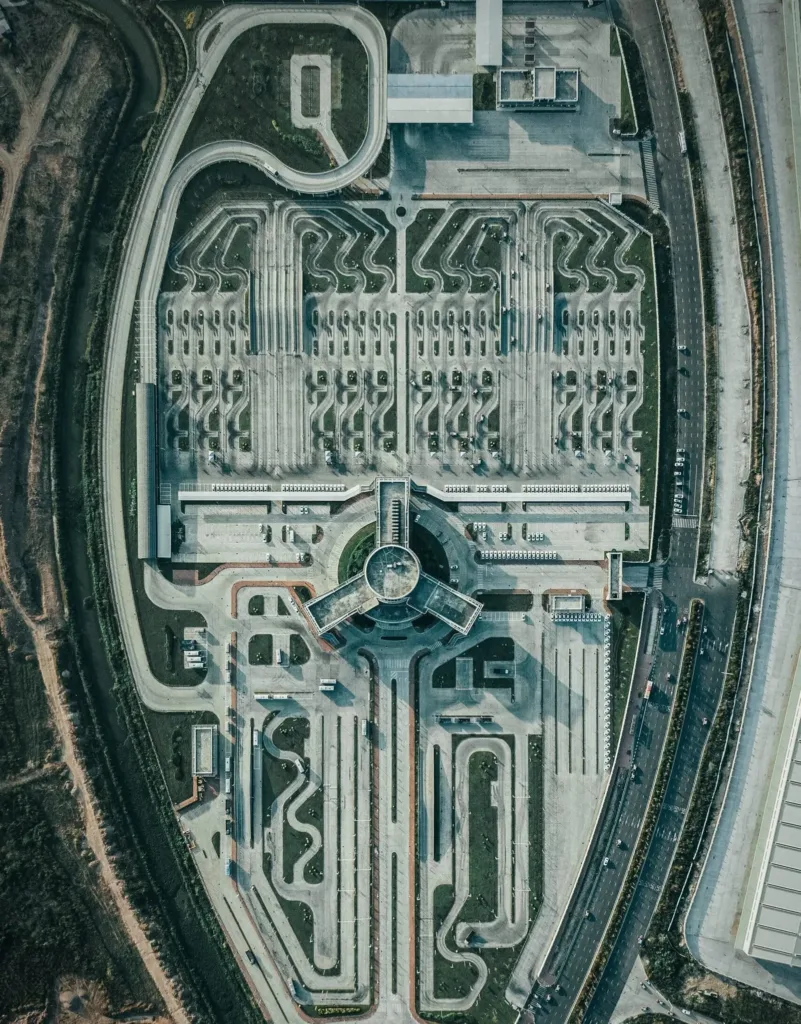

5. Strategic Reporting Framework: Tidus’s Suggested Architecture

|

Layer |

Description |

|

Data Sources |

Core banking, Murex, SAP, CRM, HR, regulatory feeds |

|

Data Engineering |

ETL pipelines, staging in Synapse/Snowflake, Power Query |

|

Semantic Layer |

Business definitions, DAX measures, table relationships |

|

Meta-Modelling Layer |

Logical entities (Client, Account, Exposure, Risk Event), reusable metrics, lineage |

|

Presentation Layer |

Power BI dashboards, paginated reports, mobile apps |

|

Governance |

Access roles, version control, audit trail, KPI ownership |

This architecture enables scalability, auditability, and cross-functional visibility — vital for banking, asset management, and capital markets.

6. Key Use Cases Across the Sector

|

Use Case |

Stakeholders |

|

Board-level financial risk dashboards |

C-suite, Risk Committee |

|

Real-time credit exposure monitoring |

Credit Risk, Treasury |

|

Capital allocation and performance |

Finance, Strategy |

|

ESG and sustainability reporting |

Sustainability Office |

|

Regulatory reporting packs (Basel, Solvency II) |

Compliance, Legal |

7. Final Thoughts: Reporting is a Capability, Not Just a Tool

Success in financial reporting does not come from deploying software alone. It comes from:

- Engineering the data models and meta-models behind the reports

- Creating an environment for governance and reuse

- Choosing the right delivery tools like Power BI that support iteration, scale, and security

- Building the capability internally to maintain and extend the system

Firms that invest in this structure are not just improving reporting — they are improving how the business sees itself, understands risk, allocates capital, and makes decisions.