Industries

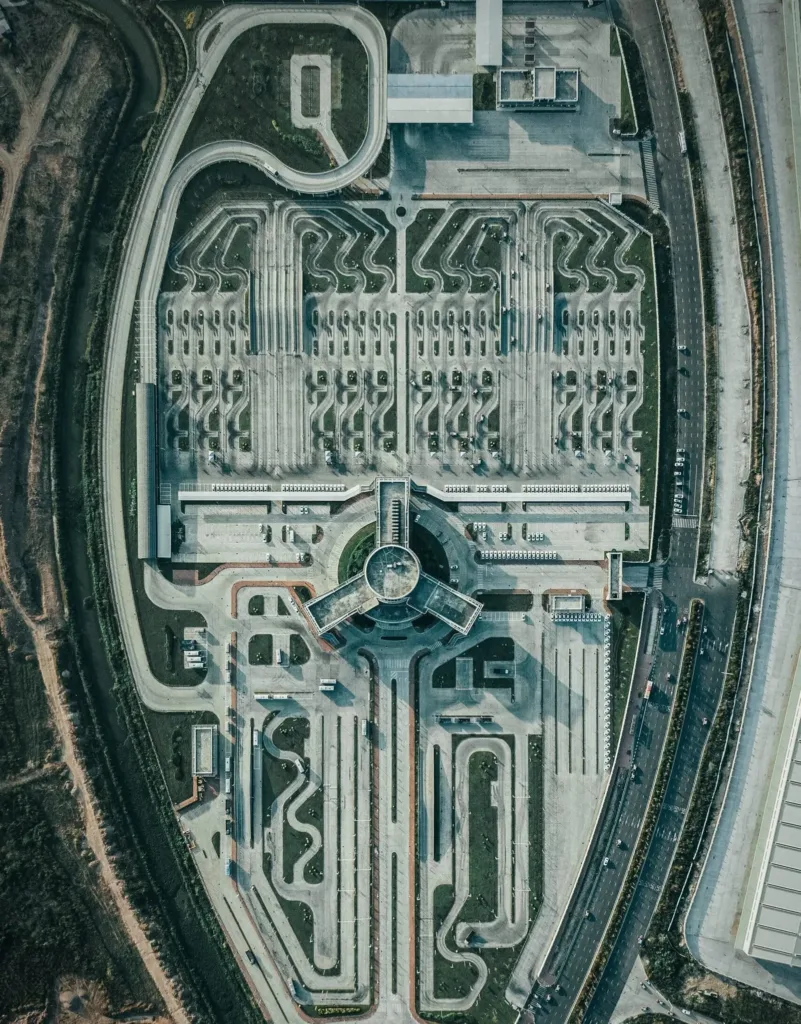

Infrastructure Projects, Mega Projects, and Investment Projects

Infrastructure, mega, and investment projects serve as the backbone of economic development. These projects, whether in energy, transportation, real estate, or public-private partnerships (PPPs), drive large-scale progress, sustainability, and socio-economic transformation.

Complex Stakeholder Management

Managing diverse interests, from governments to private investors and regulatory bodies.

Funding and Investment Risks

Balancing financial viability with long-term sustainability.

Regulatory and Compliance Complexity

Navigating legal frameworks and international standards.

Project Delays and Cost Overruns

Managing scope, budget, and timelines effectively.

Technology and Innovation Gaps

Integrating digital solutions for improved project delivery and operations.

Efficient execution, risk management, and innovation are crucial for these projects to succeed, given their complexity, long timelines, and multiple stakeholders. Strategic Approach: How We Support the Industry

Our expertise in Programme and Project Management, Business Engineering, Operations Research, and Risk and Compliance enables us to lead the execution, governance, and success of large-scale infrastructure and investment projects. We offer a structured and methodical approach to project structuring, financing, execution, operationalisation, delivery, and long-term sustainability.

- Infrastructure Projects, Mega Projects, and Investment Projects Insights and News Spotlight

THE APPLICATION OF SOME KEY SERVICES AND SOLUTONS

You can Partner with us for delivery of Infrastructure Projects, Mega Projects, and Investment Projects:

Project Structuring and Execution

Defining scope, governance, risk frameworks, and stakeholder management from initiation to completion.

Public-Private Partnerships (PPP) Advisory

Designing effective PPP models, risk-sharing frameworks, and governance structures.

Investment and Financing Strategy

Structuring investment models, financial feasibility studies, and funding mechanisms.

Portfolio and Programme Governance

Managing large-scale investment projects under structured PMO oversight.

Digital Twin and Smart Infrastructure Modelling

Leveraging AI and digital solutions for real-time project monitoring and optimisation.

Comprehensive Risk Frameworks

Implementing ISO 31000 and COSO-aligned risk management methodologies.

Regulatory Compliance and Governance

Ensuring adherence to global and local standards in infrastructure and investment projects.

Environmental, Social, and Governance (ESG) Integration

Embedding sustainability and responsible investment principles into project execution.

Contract and Claims Management

Ensuring structured handling of disputes, contract compliance, and legal frameworks.

Enterprise Architecture for Infrastructure Development

Structuring business processes, systems, and workflows for large-scale projects.

Process Efficiency and Lean Construction Management

Driving efficiency in mega-project execution through process reengineering.

Supply Chain and Logistics Optimisation

Enhancing procurement, material management, and logistics for infrastructure development.

Automation and Orchestration

Deploying digital workflows, project management automation, and real-time monitoring solutions.

AI-Driven Predictive Analytics

Using data-driven models for risk forecasting, cost control, and project optimisation.

Cloud and Data-Driven Project Ecosystems

Implementing cloud-based project collaboration and data management solutions.

Project Scheduling and Resource Allocation Optimisation

Applying mathematical models for optimal resource use and time management.

Supply Chain and Logistics Planning for Infrastructure

Ensuring cost-efficient logistics and material flow.

Capital Investment Analysis and Decision Support

Using quantitative models for investment decision-making.

Interesting topics of expansion and exploration you can use to start your engagement discussion with us:

End-to-End Management and PPP Market Growth

Technology-Enabled Infrastructure Advisory

Sustainable and Green Infrastructure

OUR PARTNERSHIP AND JOURNEY

A Day 1 Client vs A Day 300 Client

Day 1 Client:

Seeking clarity on project structuring, financing, and execution. Facing compliance, governance, and stakeholder challenges. Struggling with project delays, inefficiencies, and risk management. Lacking a data-driven, technology-enabled approach to project execution.

Day 300 Client:

Operating with a fully structured and well-governed project execution framework. Leveraging digital tools for real-time project monitoring and decision-making. Effectively managing risks, compliance, and stakeholder relationships. Implementing AI-driven project optimisation and automation strategies.

POTENTIAL ENGAGEMENT MODEL

What your engagement model with us could look like?

At Tidus we apply value to excellence, innovation, out of the box thinking, vibrance, solving problems, and executing with precision. We understand that to do this for our clients and partners sometimes requires agility, not a one size fits all approach. We apply various engagement models dependent on the work, relationship, longevity, what will allow for the best growth for our client and partner, and in consideration of the organisation. For Infrastructure, PPP, Mega, and Investment Projects the following are spotlighted.

Traditional Consulting Model

Project-based engagements with defined scope and deliverables.

Consulting as a Service (CaaS)

Ongoing advisory and project execution support.

Revenue-Share, Equity, or Investment Model

Partnering with stakeholders for long-term investment projects thorugh revenue precentages, equity, or other means. This is also applicatble to large project or entity turnarounds.

We are here to engage: Just send us an email at hello@tidus.global