This whitepaper explores how end-to-end process automation and cross-functional orchestration can help insurers and medical schemes evolve from rigid service providers to adaptive, scalable, and customer-centric platforms — while preserving compliance and cost control.

1. A Sector Built on Complexity — and Broken by Fragmentation

Medical insurers process thousands of real-time activities across disparate systems and touchpoints:

- Claims submission, validation, and payment

- Member onboarding and plan changes

- Provider credentialing and payment processing

- Pre-authorisations and case management

- Fraud detection and audit trails

- Regulatory submissions and scheme reporting

Most insurers and medical schemes operate on a legacy patchwork of platforms (e.g., AS/400, Oracle Health Insurance, TCS BaNCS, custom claims engines) with manual workarounds and disconnected workflows across business, IT, legal, and clinical teams.

The result is often:

- Delayed claims processing and member service

- Duplicate tasks and rework

- Compliance gaps and audit fatigue

- Unsustainable staff workloads

- High operational costs and error rates

2. Automation vs Orchestration — and Why Both Are Needed

- Automation eliminates manual tasks (e.g., straight-through claims processing, KYC checks, bulk communications).

- Orchestration aligns end-to-end workflows across teams, systems, and rules — handling approvals, exceptions, escalations, and data dependencies.

In medical aid and insurance, orchestration is critical because workflows are:

- Non-linear (e.g. a claim may trigger pre-authorisation, audit, or fraud alert)

- Highly regulated (e.g. privacy, payment timelines, patient rights)

- Multi-party (e.g. member, scheme, provider, broker, regulator)

- Exception-heavy (e.g. special billing codes, pending documents, plan changes)

Without orchestration, automation becomes isolated — and systemic inefficiencies persist.

3. Key Use Cases for Automation and Orchestration

- a) End-to-End Claims Processing

- Auto-validation of codes, limits, and eligibility

- Rules-based routing to human adjudication only when needed

- Seamless escalation to fraud or case review

- Auto-generated communications and remittance

- b) Member Lifecycle Management

- Trigger-based onboarding workflows (KYC, policy docs, card issuing)

- Auto-handling of plan upgrades, terminations, and benefit changes

- Integration with CRM, billing, and compliance systems

- c) Provider Management and Payments

- Credentialing orchestration with real-time verification

- Automated handling of payment cycles, rejections, and reconciliation

- Rules-driven resolution of tariff exceptions or clawbacks

- d) Pre-authorisation and Clinical Review

- Automated workflow for benefit checks, clinical rules, and approvals

- Orchestration of referrals to doctors, case managers, or second opinion panels

- e) Compliance and Reporting

- Sequenced workflows for data sourcing, validation, signoff, and audit trail

- Real-time readiness for regulators (e.g., solvency, claims ratios, consumer protection)

4. Strategic Benefits

|

Objective |

How Automation & Orchestration Help |

|

Improve Customer Experience |

Faster claims, fewer errors, self-service capabilities |

|

Boost Operational Efficiency |

Lower manual workloads, better resource allocation |

|

Enhance Compliance |

Enforce rules and audit trails systematically |

|

Reduce Risk |

Prevent revenue leakage, detect fraud, flag exceptions early |

|

Accelerate Change |

Add new plans, rules, or products without disrupting core systems |

|

Enable Scalability |

Handle more members or providers without proportional cost increases |

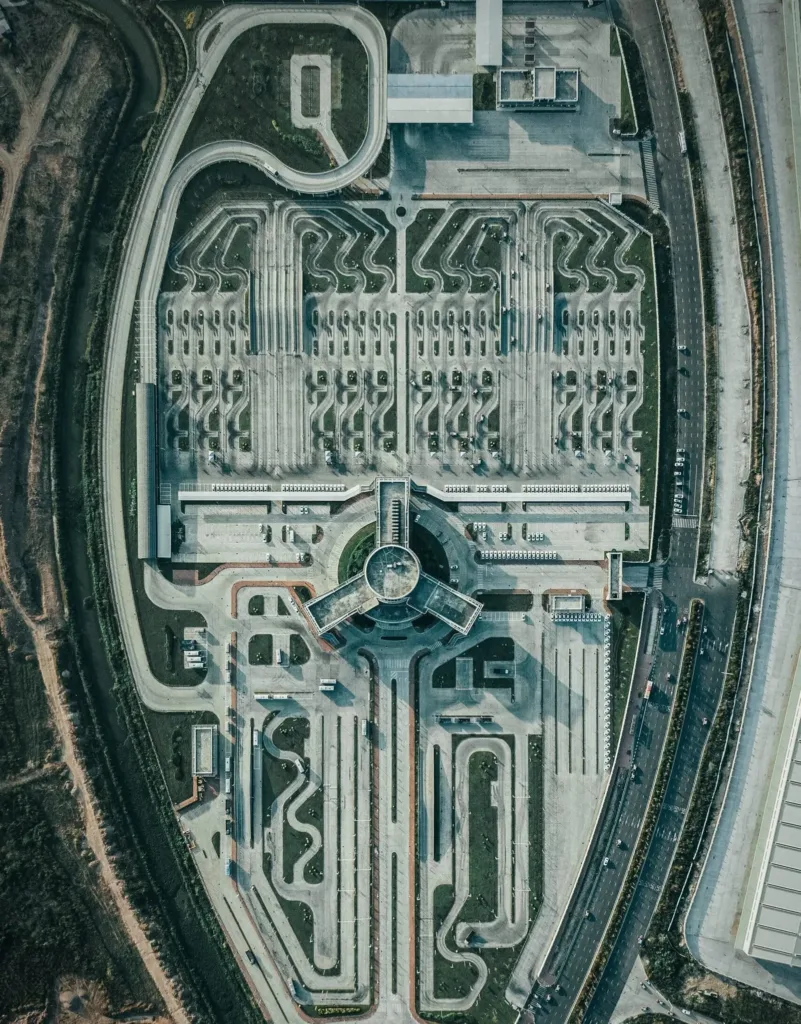

5. Implementation Approach: Orchestration as an Operating Model Shift

At Tidus, we advocate treating automation and orchestration not just as IT upgrades, but as operational redesign initiatives. Our proven approach includes:

- Process Mapping and Failure Point Analysis

- Orchestration Flow Design – Events, triggers, business rules, exceptions

- Integration with Core Systems – EHRs, CRM, billing, document stores

- Governance Layer Design – Approvals, escalation, audit visibility

- Analytics-Driven Optimisation – Identifying lag, bottlenecks, and cost drivers

We apply Operations Research principles to optimise flows, and ensure automation adds real business value, not just cosmetic speed.

6. Real Example Scenarios

|

Scenario |

Without Orchestration |

With Orchestration |

|

Claim requiring additional documents |

Back-and-forth emails, delays, manual flags |

Workflow triggers document request, pauses claim, alerts member, auto-resumes |

|

Member changes plan mid-cycle |

Manual updates across systems, error risk |

Workflow validates eligibility, updates all systems, recalculates premiums |

|

Provider audit trigger |

Missed deadlines, untracked escalations |

Auto-routing to audit team, flagged in dashboard, prepopulated data review |

Conclusion: From Bottlenecked to Borderless

In a sector where speed, trust, and compliance matter equally, automation and orchestration are no longer optional. They are the foundation for sustainable, adaptive, and customer-focused insurance operations.

Firms that invest in these capabilities now will unlock lower costs, higher member retention, and next-generation agility — gaining a clear edge in a competitive and heavily regulated environment.

Tidus helps insurers and medical aid schemes bridge the gap from rigid process to orchestrated performance — combining automation with engineered operations.