Challenge

The transformation’s goals are ambitious: accelerate time-to-market for new products, eliminate error-prone manual work, and embed compliance controls throughout. Key challenges included:

- Outdated processes & technical debt. Years of “quick fixes” have accumulated debt and fragmented workflows. Manual reconciliations and siloed data make consistent KYC/AML compliance difficult.

- Scope and stakeholder alignment. Different parts of the bank has varying priorities: IT wants a modern architecture (APIs, cloud), business leaders demand new revenue-generating products, and the CFO insists on cost control. Without careful alignment, scope creep is likely – changing requirements can double budgets and extend timelines by 50–100%.

- Regulatory complexity. Operating in multiple jurisdictions means the Bank has to simultaneously meet different central-bank reporting rules and consumer protection laws. This risks gaps in compliance if not designed from the ground up.

- Change capacity & governance. The bank has limited internal staff experienced in large IT projects. Coordinating across countries and departments risks delays and misunderstandings.

By outlining these challenges early, Tidus sets the stage for a structured transformation. With Temenos chosen for its pre-built “model bank” functionality (supporting rapid product rollout and local regulatory needs), and automation and orchestration via Tidus’ technology partnerships, the team focuses next on organisational design and delivery methodology.

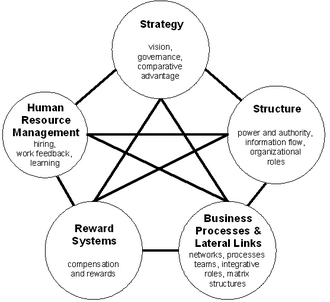

Solution – Business Engineering

Tidus begins by redesigning the Bank’s operating model holistically. This inludes strategic testing and alignment, organisation modelling and understanding, and using frameworks like Galbraith’s Star Model. The team aligns strategy, structure, people, processes, and rewards. This means updating the org chart and roles to fit an agile delivery (for example, merging IT development and business units into cross-functional squads). Process harmonization workshops map end-to-end customer journeys, eliminating duplicate tasks (e.g. manual credit approvals) and embedding compliance checkpoints (such as automated KYC rules within workflows). Tidus also conducts a “risk and compliance integration” review: risk officers work alongside process teams to ensure that every new functionality (e.g. digital onboarding on Temenos Infinity with a chosen Temenos Partner and Vendor, automation implementation with Tidus technology, and orchestration implementation) included built-in controls and audit trails. For instance, new digital account opening on Infinity incorporates the latest ID/AML logic from day one, rather than as an afterthought.

Solution – PMO and Governance

A robust PMO structure manages the multi-phase rollout. this will also be maintained and operated within the company for the foreseable future to handle all other projects across the enterprise. Tidus divides the implementation into iterative waves (e.g. retail banking, then corporate banking), each ending in a go-live. This avoided the pitfalls of a single “big bang” launch. Within each phase, agile practices are used: cross-functional sprint teams (with business SMEs, IT engineers, and compliance leads) deliver small increments of Temenos, Automation, and Orchestration configuration and integration. Senior stakeholders are aligned through regular steering committees. Tidus enforces a formal change-control board to prevent scope creep – all change requests were vetted against the project charter and regulatory needs. This approach reflects best practices: note that successful banks often set up agile delivery before the transformation and run sprint teams with continuous integration, and schedule intermediate go-lives every 12–18 months to lock in progress. In the banks case, the first wave (retail deposits and payments) could go live in months 9–10, with later waves following at 6-month intervals.

Solution – Operations Research (OR)

To optimise resources and minimise disruption, Tidus applies OR techniques. For example, they build simulation models to plan the transition of branches and call centres from the old system to be automated, have orchestration for control and to use Temenos. This “change capacity” model calculates how many staff hours each department could absorb per month without impacting customer service. Based on this, Tidus stages parallel run-tasks and training. They also quantify technical debt: every legacy module is scored by complexity and usage, so Tidus can phase out the riskiest old code first. This planning ensures that at each iteration, the bank retires a portion of legacy infrastructure. Resource allocation is similarly modelled: Tidus matches scarce skills (e.g. Temenos specialists) to modules using optimisation, shortening the overall timeline. The OR approach keeps the project on a defined path and preventing delays due to overcommitting bank staff.

Results

The Tidus-partnership delivers strong results. The Bank meets its time-to-market goals: new retail products (mobile loans, instant transfers) launch roughly 50% faster than before, echoing Automation, Orchestration, and Temenos customer outcomes. The first core banking wave goes live at an amazing pace in the African context (for comparison, a Libyan bank achieved a 10-month go-live and 50% faster product launches with Temenos). Manual operations plummet: routine teller and back-office work is automated, cutting processing costs. Compliance gaps are closed as designed: internal audits confirm that every product now complies with local regulations and IFRS reporting rules end-to-end. The new solution is fully “cloud-ready and API-first,” enabling open-banking links to fintech partners. Importantly, adoption is high: 90% of staff passed Automation, Orcehstration, and Temenos certification training and daily Active User sessions grow steadily.

The governance and risk discipline pais off. The project stays within 10% of its original budget (avoiding the large overspend warned by industry studies) and hit the planned launch dates each phase. Stakeholders remain engaged: the steering committee (CEOs, CFO, CIO, regulators) meet monthly, so no hidden issues surface late. Critically, customer satisfaction scores improve with the new digital channel reliability and product velocity.

Future Outlook

With the core now modernised, the Bank (eg. Safiri bank) is well-positioned for further innovation. The Tidus team sets up a post-go-live support framework, living PMO, and a Continuous Improvement squad. The agile delivery model will continue – new features can be rolled out in quarterly sprints. On the horizon, Tidus plans future upgrades (e.g. AI-based credit scoring, expanded mobile wallets). The bank’s leadership sees the result as a sustainable foundation: they now have an agile platform that will adapt as regulations evolve and as African digital finance continues to surge. The Banks’ experience exemplifies how a disciplined, end-to-end transformation (spanning operating model, governance and technical planning) can succeed where many core migrations fail.