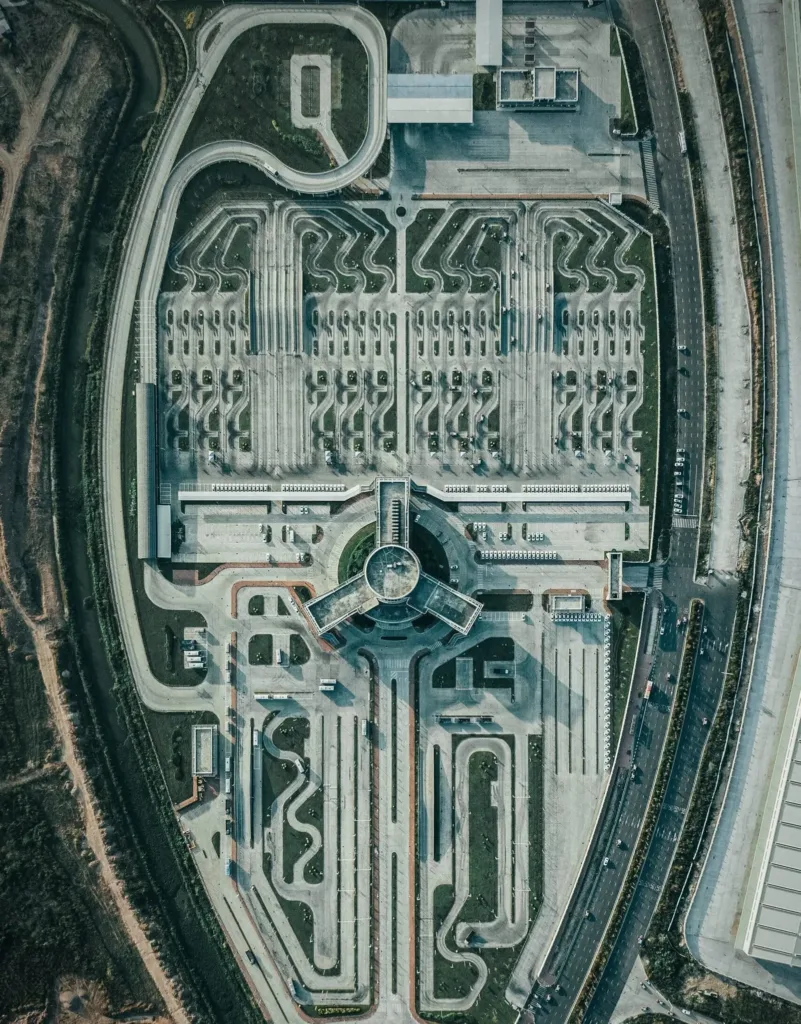

This whitepaper explores the urgent need for Automation and Orchestration to modernise front-to-back operations in capital markets, asset management, hedge funds, and private equity. It presents a framework for eliminating fragmentation, improving control, and enabling adaptive execution across complex workflows.

1. The Industry Problem: A Legacy of Fragmentation

Financial institutions have invested heavily in core systems — from portfolio management, trading, and risk engines to middle-office reconciliation and back-office accounting. However, few have solved the real issue:

the lack of connected execution across the lifecycle of transactions, positions, and risk.

Core challenges:

- Manual workarounds across systems (Excel, email, RPA patches)

- Siloed front/middle/back office operations

- Delayed or inconsistent data propagation (from trading to accounting)

- Opaque exception handling and weak audit trails

- Excessive headcount to maintain compliance and process integrity

- Inflexibility in adapting to regulatory or market changes

Even with platforms like Murex, Calypso, BlackRock Aladdin, Charles River, SimCorp, or Eze, firms often lack a true execution and orchestration layer that brings speed, adaptability, and governance.

2. What Is Orchestration, and Why Is It Different?

Automation executes tasks.

Orchestration governs, sequences, and integrates those tasks across multiple systems and teams, with business logic and exception management.

In capital markets, orchestration means:

- Tying trade capture to real-time margin, risk, and compliance checks

- Linking portfolio changes to investor communications and performance reporting

- Automating pre/post-trade checks while allowing for intelligent overrides

- Managing exception queues with prioritisation logic and escalation paths

- Aligning fund lifecycle events (subscriptions, distributions, valuations) with operational workflows

3. Priority Use Cases Across the Industry

- a) Trade Lifecycle Orchestration

Connect trade initiation, risk validation, clearing, settlement, and position updates across platforms like Murex, Fidessa, and Calypso. Reduce settlement breaks and compliance gaps.

- b) NAV Production and Valuation Automation

Orchestrate pricing, reconciliation, approvals, and investor reporting in asset managers or hedge funds — integrating SimCorp, Geneva, or proprietary platforms.

- c) Private Equity Deal Execution and Fund Admin

Coordinate legal, regulatory, tax, funding, and investor workflows in deal execution — automating workflows from deal room to SPV setup to capital call.

- d) Client Onboarding and Regulatory Checks

Integrate KYC, AML, credit checks, and document workflows into an orchestrated onboarding engine — reducing onboarding time from weeks to days.

- e) Regulatory Reporting Automation

Build orchestration flows that capture source data, apply rules (e.g., EMIR, SFDR, MiFID), and manage approval chains across departments and jurisdictions.

4. Business Impact: What Orchestration Changes

|

Metric |

Before Orchestration |

After Orchestration |

|

Process Cost per Trade |

High due to manual validation |

Reduced via rules-based routing |

|

NAV Timeliness |

Delays due to fragmented handoffs |

Real-time exception-based processing |

|

Regulatory Compliance Risk |

Reactive and fragmented |

Proactive, traceable, and auditable |

|

Operational Resilience |

Dependent on people, prone to error |

System-driven, scalable under pressure |

|

Investor Transparency |

Slow, disjointed communication |

Consistent, orchestrated updates |

|

Staff Productivity |

Time spent fixing breaks |

Time spent on oversight and analysis |

5. Our View: Structured Orchestration as Strategic Infrastructure

At Tidus, we view Automation and Orchestration not as technical bolt-ons, but as a core layer of modern operating models — enabling institutions to move from complex to controllable.

Our structured approach includes:

- Process Engineering: Mapping the business logic, risk points, and control layers

- Systems Integration: Connecting systems like Murex, Temenos, SimCorp, Calypso, Aladdin, and internal tools

- Execution Governance: Defining escalation, override, and audit workflows

- Exception Intelligence: Building intelligent monitoring, triage, and rerouting rules

- Model-Based Optimisation: Using Operations Research to simulate, refine, and measure process performance

6. Why It Matters Now

Institutions that fail to orchestrate are already behind:

- Regulators demand real-time, auditable, cross-system execution

- Clients expect faster onboarding, transparent reporting, and frictionless service

- Competitors are lowering cost-income ratios through digitised, adaptive workflows

- Talent prefers to work in high-value roles — not fix broken spreadsheets

Without orchestration, automation is tactical. With it, it becomes transformative.

Conclusion: The Case for Intelligent Execution

In a world of rising complexity and shrinking margins, financial firms need more than new systems — they need new execution models. Orchestration is the missing link that allows complex operations to be automated, governed, and scaled with confidence.

Tidus offers a structured, execution-driven approach to Automation and Orchestration for capital markets, asset managers, hedge funds, and private equity. We do not just digitise — we re-engineer the way institutions operate.