Executive Summary

From core banking transformations to risk engines and capital markets platforms, financial institutions invest billions annually in enterprise technology. Yet project failure remains a systemic risk. The core problem is not the technology itself—be it SAP, Murex, Temenos, Finastra, or Thought Machine—but the delivery mechanism.

This whitepaper explores how poor project management is the single greatest cause of underperformance in platform initiatives. It argues for a radical shift: from mechanical project tracking to intelligent project orchestration, and from delivery ownership residing in vendors or SIs to strategic in-house command of execution. Tidus presents a new blueprint for banks and asset managers to regain control, reduce systemic implementation risk, and deliver meaningful value from complex technology projects.

1. The Current State of Delivery Failure in Financial Platforms

- a) Billions Lost in Underperforming Projects

- 70% of core banking transformations exceed budget or fail to meet business expectations.

- Capital markets platform upgrades, especially Murex and Calypso, frequently overrun due to scope instability and delivery fatigue.

- Cloud-native newcomers like Thought Machine or 10x Banking still fail when delivery governance is weak—even if the tech is sound.

- b) Symptoms of Project Breakdown

- Scope creep disguised as “agility”

- Business disengagement after initial planning

- PMO roles filled by procedural gatekeepers, not strategic coordinators

- Vendor-led execution with poor integration to internal governance

- Silos between business, compliance, architecture, and delivery

These are not project management failures in isolation — they are signs of a system problem.

2. Why Traditional Project Management is Not Enough

The classic tools — Gantt charts, status reports, and risk registers — were built for predictable, linear initiatives. Today’s platform programmes are multi-dimensional, uncertain, and laden with organisational friction.

|

Traditional Approach |

Real-World Challenge |

|

Static milestones |

Dynamic market and regulatory shifts |

|

SI-led timelines |

Internal capacity gaps and dependency risks |

|

Business sign-off only at UAT |

Misaligned value and disengagement |

|

PMO reporting upwards only |

No systemic learning or issue prevention |

What is needed is a shift from tracking to steering — from templates to intelligent operations — and from external dependency to internal leadership.

3. The New Blueprint: Strategic Execution in Financial Platforms

Tidus proposes a delivery framework tailored for the financial sector, rooted in Operations Research, programme intelligence, and architectural alignment.

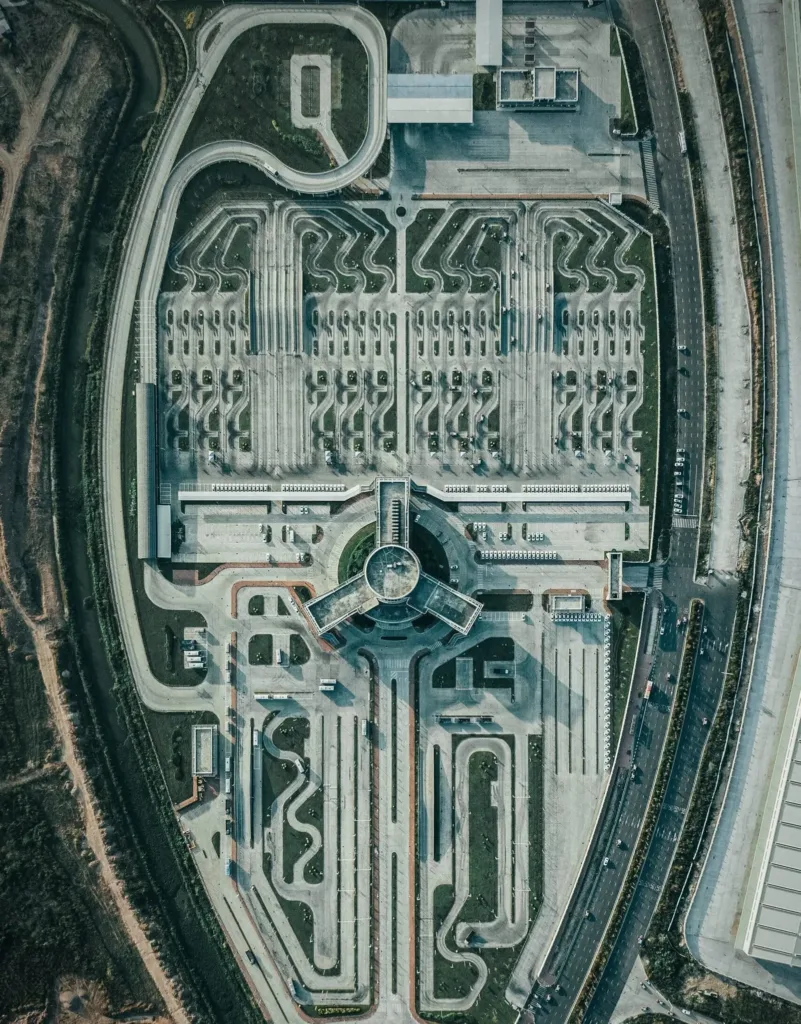

a) Execution-as-a-System: A Control Tower for Change

- Build a strategic delivery office with visibility across architecture, data, vendor commitments, risk posture, and business objectives.

- Integrate PMO with systems modelling, OR tools, and real-time delivery signals.

- Create execution feedback loops — not just progress reviews.

b) Project Management Beyond Process

- Inject business analysts and architects into programme cores, not just at the start.

- Apply Operations Research techniques to prioritise, optimise, and simulate project paths, resource allocations, and schedule risks.

- Measure value-to-date — not just cost-to-date.

c) Multi-Stakeholder Alignment by Design

- Embed compliance, cyber, architecture, risk, and business change leads as structured roles — not periodic check-ins.

- Treat vendor and SI management as a discipline, not a passive oversight.

- Formalise issue resolution tracks that address root causes, not symptoms.

4. Use Case Snapshots: When Project Management Fails or Wins

USE CASE 1

Platform: Temenos Core Banking

Problem: Fragmented vendor oversight and no PMO integration with data migration or testing.

Outcome: Go-live delayed by 12 months; parallel run failed; losses written off.

What was missing: Architecture-informed PMO, performance-based milestones, and operations simulation.

USE CASE 2

Platform: Murex Migration from v2.11 to v3.1

Problem: Programme led by a vendor PM; business involvement fell off after design sign-off.

Outcome: System went live, but PnL reconciliation and risk reporting misaligned for months.

What was missing: Business-anchored delivery model, end-to-end test scenarios, and OR-based impact modelling.

USE CASE 3 (Success)

Platform: SAP FPSL and S/4HANA

Approach: Client created an internal Project Intelligence Unit working alongside Tidus.

Outcome: 10% acceleration in delivery, 40% fewer change requests, smooth transition to post-go-live support model.

5. Why This Matters Now

- Cost pressure is higher than ever. Delayed ROI can collapse programme justification.

- Regulatory intensity makes programme failure a risk to licence integrity and compliance.

- Talent scarcity in technical delivery makes coordination even more critical.

- Capital allocators and shareholders are watching programme execution as a proxy for institutional effectiveness.

Project Management is no longer a delivery function. It is a strategic capability.

6. Tidus Value Proposition

Tidus redefines project management as a cross-functional, analytical, and strategic engine. Our capabilities include:

- Strategic PMO-as-a-Service with banking, capital markets, and asset management domain fluency

- OR and AI-enhanced delivery models for schedule and trade-off simulation

- Root Cause Analysis (RCA) frameworks for failed initiatives and turnaround management

- Programme architecture and system interface design for large platform implementations

- Governance and reporting systems to drive both board-level and operational confidence

Conclusion

Project management is not failing because of bad intentions — it is failing because the complexity of financial platform programmes has outgrown traditional tools and roles.

To deliver SAP, Murex, Temenos, or next-gen banking platforms successfully, banks must treat project execution as a strategic discipline. With Tidus, they can do exactly that.