Executive Summary

- Legacy core systems are a critical bottleneck. Most banks spend the majority of their IT budget on outdated core maintenance. Monolithic legacy architectures make even minor changes slow and costly. As a result, banks struggle with high costs and slow time-to-market.

- Cloud-native cores offer a breakthrough. Modern platforms (e.g. Thought Machine’s Vault, Mambu, nCino) use microservices and smart contracts to eliminate these limits. They deliver reduced IT costs, higher developer productivity, and much faster product deployment. Banks can move from monthly or yearly update cycles to near-continuous delivery.

- Structured transformation is essential. A consulting partner like Tidus combines business engineering, advanced operations research, and a world-class PMO to guide the migration. This ensures accelerated time-to-value, prevents scope creep (bloat), and optimizes resource use. Rigorous governance and risk-management keep compliance on track even as the bank modernizes.

- Business outcomes include cost control and agility. By decommissioning old core components, banks reallocate staff from maintenance to innovation. Cloud platforms provide high resilience (multi-zone availability and automated recovery) and ready support for real-time analytics and open-banking integrations. The result is lower total cost of ownership, faster product roll-out, and the agility to respond quickly to market and regulatory changes.

Challenges of Legacy Core Systems

Banks with decades-old core platforms face severe operational challenges. These monolithic systems are expensive to maintain – studies estimate banks spend roughly 60–80% of IT budgets just on keeping legacy cores running. For example, one report found banks spent $36.7 billion in 2022 on outdated payment systems, projected to grow to $57 billion by 2028. Staffing these cores is also costly: COBOL specialists command 2–3× higher rates, and teams waste hours per week just applying patches.

- Slow product delivery. Legacy cores take months to implement simple changes. A small product update or rate change on a mainframe can require extensive coding and testing. This slows time-to-market and frustrates customers and business units.

- Technology lock-in and complexity. Deeply customized legacy code and tightly coupled modules create a web of dependencies. This “spaghetti” architecture breeds technical debt: core functionality is often intertwined with custom interfaces or third-party add-ons. Banks lack a single source of truth, hurting personalization and analytics. In fact, many banks now report that their #1 core pain is the inability to process data and transactions in real time. Without instant data flows, new pricing models, fraud detection, or customer analytics cannot be fully leveraged.

- Regulatory and operational risk. Aging systems pose compliance risks. Hard-coded rules and manual processes make audit, reporting, and change management cumbersome. Many banks experience “legacy bloat,” where outdated components run long past decommission plans, dragging out costs. Ultimately, banks with outdated cores face higher failure rates, longer downtimes, and growing vulnerability to cyber and operational incidents.

Modern Cloud-Native Core Platforms

Cloud-native core banking platforms (e.g. Thought Machine Vault, Mambu, 10x, FinXact, nCino) address these challenges by re-architecting the core with modern technology. They use elastic cloud infrastructure, microservices, APIs, and in-memory ledgers to enable real-time, scalable operations. Unlike legacy mainframes, these platforms are designed for continuous deployment, horizontal scaling, and open integrations. Key benefits include:

- Reduced IT costs and technical debt. By moving to cloud services, banks avoid large datacenter overhead and obsolete hardware. Development on standardized platforms raises productivity: banks “can cut spending through higher developer productivity and removal of technical debt”. Scale is on-demand (pay-as-you-go), so costs drop as capacity rightsizes automatically. IDC notes that cloud-native platforms reduce timelines, efforts, and manpower for core migration. In practice, many banks reallocate resources – moving staff from legacy upkeep into new product development.

- Accelerated time to market. Modern cores use configurable product engines (often via “smart contracts”) so new products and features are defined in code or configuration, not buried in monoliths. McKinsey observes that hyper-parameterized configuration and automated testing on these platforms allow “easier and speedier” product rollout. In one IDC study, banks reported that cloud cores enable on-demand transaction data access for instant pricing and customization at point-of-sale, driving higher customer satisfaction.

- Real-time processing and agility. A cloud-native core can process transactions as they occur. According to industry research, 60–69% of banks cite “lack of real-time capabilities” in legacy systems as their top constraint. New platforms remove this barrier, providing in-memory processing and APIs so that balances, decisions, and analytics update live. This not only improves customer experience (instant alerts, dynamic pricing) but also strengthens fraud detection and risk management.

- Modular extensibility. Microservices and open APIs let banks mix best-of-breed components (e.g., fraud engines, analytics, CRM) and swap them out without rewriting the core. For example, Thought Machine’s Vault uses a Universal Product Engine where every product’s logic is defined in smart contract code. This means banks no longer wait for the vendor or maintenance windows to launch a new loan type or payment feature; they deploy it themselves through configuration. In summary, platform agility enables banks to form partnerships (e.g. open banking), enter new markets, and personalize services in ways impossible under older cores.

- Resilience and scalability. Cloud cores are designed for high availability across regions. IDC highlights that migrating to multi-zone, containerized architectures delivers “availability and reliability” (the #4 benefit banks cite). Automatic failover, self-healing infrastructure, and continuous operations mean fewer outages and quicker recovery. These platforms also address regulatory uptime requirements more easily than on-premise hardware.

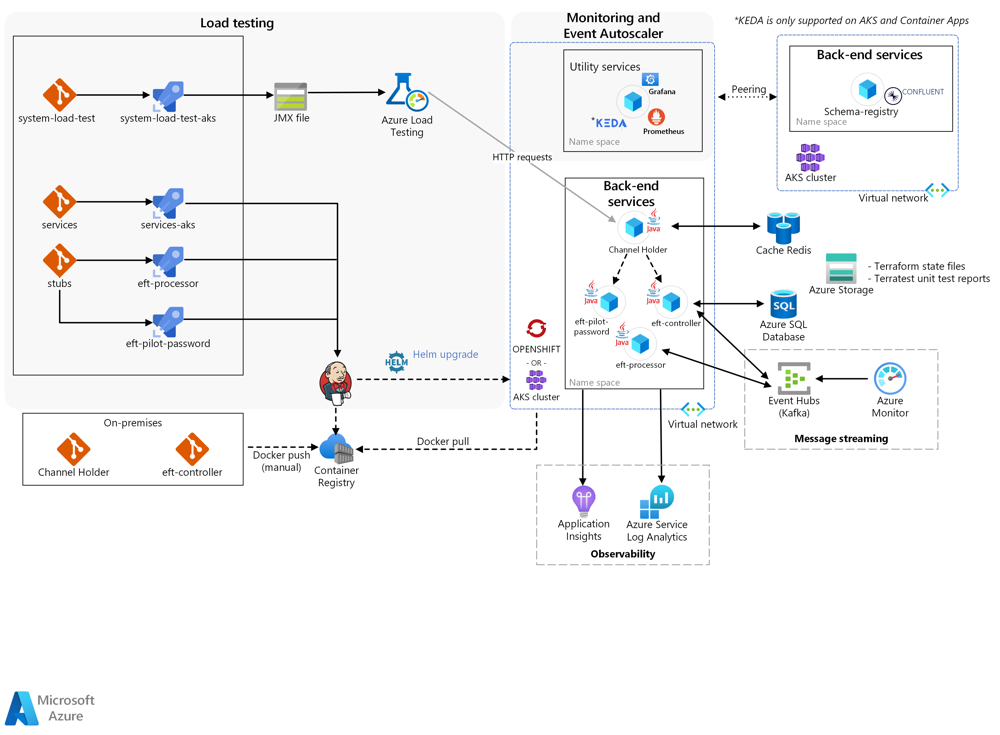

A cloud-native core banking architecture (example above) uses scalable microservices and event-driven workflows for transaction processing. This distributed design lets banks replace inflexible monoliths with modular, API-driven services. It accelerates innovation: simple updates that took months on legacy systems can be made rapidly via standardized APIs and automated deployment. It also supports high resilience and elasticity, since resources can be scaled automatically and distributed across zones.

Consulting-Led Transformation Approach

Even with a great platform, core migration is a large program of work that affects the entire bank. Consulting firms like Tidus play a crucial role by blending technical and operational expertise. Tidus’s integrated services are anchored by a specialist Project Management Office (PMO) and include business engineering and operations research. This means that transformations are treated as strategic business initiatives, not just IT projects. Key elements of the approach include:

- Business Engineering and Target Operating Model (TOM) design. Tidus works with the bank’s leadership to map business processes to the new platform’s capabilities. This ensures the solution addresses true business requirements, from customer journeys to risk management. For example, a retail bank might redesign its lending process to fully leverage the platform’s real-time credit decisioning. By applying systems thinking, business engineering prevents “lift-and-shift” of inefficiencies. It also helps define what needs to change now vs. later, focusing on modules that deliver the highest value (e.g. frontline products, digital onboarding).

- Dedicated PMO and Governance. A strong PMO establishes clear governance structures: steering committees, risk boards, and stage gates. This disciplined oversight is critical to accelerate time to value while controlling scope. McKinsey warns that long, waterfall core projects tend to “cause scope creep” and 50–100% cost overruns. In contrast, Tidus implements an iterative release plan with periodic go-lives (every 12–24 months) to lock in value early and adapt to change. The PMO manages dependencies with other programs (e.g. data migration, channel upgrades) and enforces a tight scope to avoid over-customization. It also bridges the bank and the platform vendor, ensuring joint accountability.

- Resource and Cost Optimization. Operations research methods are used to optimize resource allocation across the transformation. This includes scheduling the right mix of skill sets (developers, testers, business analysts) at the right times to prevent bottlenecks and idle capacity. For example, simulation models can forecast effort across modules, so additional contractors or centers of excellence can be engaged just-in-time. Budgeting is aligned to phased delivery: rather than funding a decade-long overhaul, funds are committed incrementally as each phase delivers business capabilities. Such optimization controls costs and focuses investment where ROI is highest.

- Risk Management and Compliance (“Risk by Design”). Crucially, Tidus embeds risk and compliance controls into every phase. Risk functions, regulatory teams, and security specialists are involved from the start – not as an afterthought. According to McKinsey, neglecting this leads to delays (one bank faced a 5-month delay when traditional control teams lagged behind an agile delivery). Tidus promotes “risk by design” (per McKinsey) by integrating compliance checkpoints into agile ceremonies and CI/CD pipelines. For example, automated controls and audit logs are built into test scripts; legal teams validate product changes via the same sprint cadences as developers. This approach avoids last-minute remediations and ensures regulatory requirements (e.g. capital calculation accuracy, audit trails, security standards) are met continuously.

By combining these elements, Tidus helps banks accelerate value from day one. Even before full cutover, banks can see live benefits in targeted areas: for instance, migrating the retail deposits module first might immediately improve processing speed and reduce straight-through-processing failures. The focus is always on delivering visible outcomes (like launching a new digital savings product or real-time fraud alert) at each milestone. This builds confidence and maintains stakeholder buy-in throughout the multi-year journey.

Managing Scope and Change

A major risk in core programs is uncontrolled scope growth. Tidus’s governance framework tightly manages this: every requested enhancement is evaluated against the original business case and transformation priorities. Our PMO uses formal change control, linking each change to customer impact or regulatory necessity. Banks that skip this have faced runaway costs – McKinsey found projects overspending by 100% when scope ballooned over lengthy timelines. Tidus avoids this by locking in a “core minimal viable product” at each phase and treating new requirements as discrete follow-on tasks. We also resist over-customization: as McKinsey warns, choosing vendors or designs based solely on price often leads to complex one-off interfaces and scope changes. Instead, we ensure platform best practices are used and any customization is globally necessary.

To optimize resource use, Tidus frequently models scenarios (e.g. Gantt charts, critical-path analyses) to identify idle time or over-allocation. For example, we may re-sequence integration tasks so that teams can parallelize work on separate modules. By applying such operations-research techniques, banks can typically reduce overall project staffing needs while still meeting aggressive timelines.

Ensuring Business Continuity and Compliance

Throughout the transition, operational control is paramount. Tidus helps banks maintain dual-running of legacy and new systems until confidence is proven. As Oliver Wyman notes, an active/active coexistence strategy lets both cores run in parallel, with mirrored transactions for testing. This dual-run approach delivers high visibility – outputs from each system can be compared live to catch any regressions. A complementary active/passive mode can then be used to validate the new core’s outputs over time. These techniques significantly reduce the risk of cutover shocks or undetected defects.

Meanwhile, regulatory reporting and audit processes continue uninterrupted. Tidus designs the migration so that data feeds (e.g. to finance systems, compliance repositories) are maintained. Any changes to processes (e.g. KYC, AML workflows) are mapped and re-implemented in the new platform under the guidance of our risk specialists. Regular reviews with regulators and auditors are held, showcasing compliance controls in the new environment. This preserves the bank’s control posture and avoids fines or examination findings – a bank missing embedded controls, for instance, can face regulatory pushback or delays.

Finally, Tidus establishes a Transformation Management Office (TMO) – essentially an empowered PMO – that spans the entire program. The TMO tracks benefits realization (e.g. cost savings from retired hardware or FTE reallocation) and ties them back to the original business case. This ensures the board sees continuous ROI and the transformation stays funded to completion. Early and regular benefit realization is a proven tactic to “keep stakeholder buy-in high” through a long program.

Partnership with Core Platform Providers

Consulting firms like Tidus do not work in isolation – we collaborate closely with platform vendors (Thought Machine, Mambu, nCino, etc.) to speed deployment and extend platform value. This partnership creates a “product + services” approach: the bank adopts a best-practice core product, while Tidus customizes and integrates it with minimal heavy code changes. By working with Thought Machine, for instance, we leverage their Vault Core product library and acceleration tools, allowing the bank to launch many standard products out-of-the-box and then refine them with smart contracts. Our expertise means we avoid common pitfalls: for example, we guide the bank to use the platform’s native configuration features rather than building costly workarounds, preventing scope creep.

Moreover, Tidus’s PMO can help arbitrate any deliverables schedules or issues with the vendor team. We apply the vendor’s best practices framework (where available) alongside our own methodologies. This dual governance – vendor Agile process plus Tidus’s risk management – further reduces delivery risk. In practice, banks with such partnerships see faster on-boarding of new capabilities and smoother upgrades. They also get help tailoring the platform roadmap to their specific regulatory and product strategy, extending the platform beyond initial launch.

Business Outcomes and Benefits

A successful transformation delivers clear operational and business advantages:

- Cost Control and Efficiency: By decommissioning legacy systems, banks eliminate their upkeep costs. IDC research highlights that retiring old core software and shifting staff away from maintenance frees up budget for innovation. On the new platform, banks cut hardware and manual testing expenses – McKinsey notes banks can “cut spending through higher developer productivity” on cloud cores. Many banks see immediate improvements in cost-to-income ratios as IT spend shifts to OPEX and usage-based pricing.

- Improved Resilience and Compliance: Cloud architectures bring built-in redundancy (multi-zone failover) and advanced security controls. Banks achieve higher system availability and disaster recovery capabilities. The transformation process itself enforces updated risk controls. As a result, the bank is more resilient to failures and better positioned to meet evolving regulations (e.g. ISO 20022, open-banking data sharing).

- Faster Product Rollout: New products and features can be introduced in weeks instead of months. With automation and pre-built product templates, banks quickly prototype and release innovations (loyalty programs, digital wallets, etc.). This agility helps capture market opportunities ahead of competitors. For example, IDC cites a case where a bank launched a new digital bank within 12 months on a cloud core, servicing hundreds of thousands of customers.

- Platform Agility: The new core becomes a flexible foundation, easily extended with AI/ML analytics, partner fintech services, or emerging channels. Tidus ensures the bank’s IT roadmap remains aligned to use these new capabilities. Over time, this agility creates a virtuous cycle of innovation – the bank can iterate and scale products quickly as customer needs change.

In summary, by combining a modern core platform with disciplined consulting-led transformation, banks achieve robust operational control along with strategic agility. They move from reactive firefighting to proactive innovation. Cost structures stabilize, while the bank’s ability to launch new offerings and respond to market or regulatory shifts is dramatically enhanced.

Conclusion

Legacy core banking systems are no longer sustainable for forward-looking banks. Modern cloud-native platforms present a clear path to solving this pressing operational challenge. However, the journey involves complex change across people, processes, and technology. A consulting partner like Tidus brings the necessary blend of project leadership, business engineering, and analytical rigor to make the transition successful. Through structured governance, resource optimization, and embedded compliance, Tidus helps banks accelerate time to value, avoid unnecessary bloat, and optimize resources throughout the journey. The payoff is significant: controlled costs, faster time-to-market, improved resilience, and a foundation for continuous innovation. By partnering closely with core platform providers and applying proven methodologies, Tidus accelerates adoption, lowers delivery risk, and maximizes the platform’s impact on business outcomes.

Banks that embrace this approach position themselves not just to survive, but to thrive, in the digital age – delivering next-generation banking services with agility and efficiency, while maintaining rigorous control and compliance.